Registered Tax Agent with the Tax Practitioners Board

At Australian Accountants, we take compliance and professionalism seriously. Our team is fully registered with the Australian Tax Practitioners Board (TPB), ensuring we meet all legal and professional standards set forth by the Tax Agent Services Act 2009 (TASA). The TPB is a national regulatory body responsible for registering and overseeing tax practitioners across the country. This includes ensuring adherence to the Code of Professional Conduct, which governs the ethical and professional behaviour of tax agents.

Our registration guarantees that we are authorised to provide tax agent services for a fee, giving you peace of mind that your tax matters are in safe, qualified hands.

Who is a Tax Agent?

A tax agent is a licensed professional authorised to assist individuals and businesses with their tax obligations, including:

- Preparing and lodging tax returns.

- Providing tax advice specific to Australian tax laws.

- Representing clients in dealings with the Australian Taxation Office (ATO).

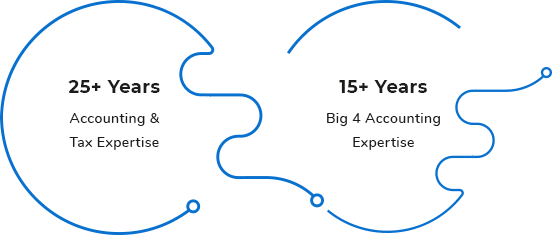

By choosing Australian Accountants as your tax agent, you benefit from our years of expertise and in-depth understanding of the Australian tax system.

Why You Need a Registered Tax Agent

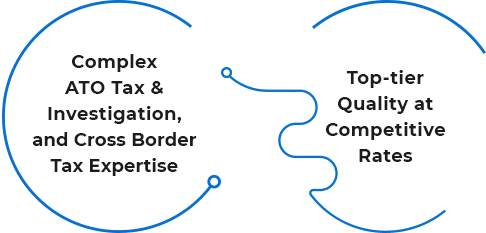

Professional Expertise and Compliance

Navigating the complexities of the Australian tax system can be challenging. A registered tax agent like Australian Accountants ensures that:

- Your tax returns are accurate and lodged on time.

- You remain compliant with all relevant tax laws and regulations.

- You maximise deductions and minimise liabilities within legal boundaries.

ATO Representation

Dealing with the Australian Taxation Office (ATO) can be stressful. As your tax agent, we handle all communications with the ATO on your behalf, including:

- Responding to queries or audits.

- Managing disputes or overdue lodgements.

- Submitting payment plans or extensions when needed.

Our Services

We specialise in a broad range of tax agent services for individuals and businesses, including:

For Individuals

- Income Tax Returns: Maximise your refund with precise preparation and lodgement.

- Capital Gains Tax (CGT): Guidance on property sales, share trading, and other investments.

- Tax Deductions: Strategic advice on work-related expenses, education costs, and other deductible items.

For Businesses

- Business Activity Statements (BAS): Accurate and timely BAS preparation and lodgement.

- Tax Planning: Strategies to minimise your tax liability and optimise financial outcomes.

- Fringe Benefits Tax (FBT): Compliance and reporting assistance for employee benefits.

- GST Management: Registration, reporting, and compliance services for GST obligations.

For Sole Traders and Freelancers

- ABN Tax Compliance: Ensure your Australian Business Number (ABN) obligations are met.

- Self-Employed Tax Advice: Tailored guidance on deductions and superannuation.

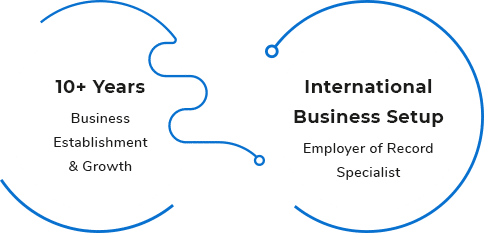

International

International

Business

Business

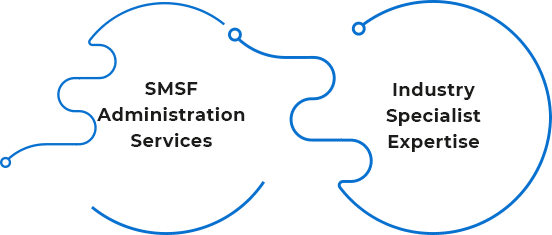

Personal

Personal

SMSF

SMSF