Foreign Investment in Australia: A Land of Opportunity

Australia’s robust economy and strategic location in the Asia-Pacific region make it a prime destination for foreign investment. This guide explores the key factors driving foreign investment in Australia and the benefits it offers to international businesses.

Economic Stability and Growth

- Strong GDP Performance: Australia boasts consistent economic growth, outperforming many global counterparts.

- Diversified Economy: Foreign investment in Australia benefits from a diverse economic landscape, extending beyond traditional mining and resources sectors.

- Post-Pandemic Resilience: Australia’s swift post-pandemic recovery highlights its economic stability and attractiveness to investors seeking secure environments for expansion.

- Thriving Service Sector: Over 80% of Australia’s GDP comes from the service sector, presenting a wealth of investment opportunities in technology, healthcare, finance, and renewable energy. These sectors align with global trends and leverage Australia’s innovation and skilled workforce.

———————————————————————————————————————-

Transparency and Regulation

- World-Class Regulatory Framework: Foreign investment in Australia benefits from a transparent and well-established regulatory framework designed to protect investor interests and ensure stability.

- Investor Protection: Laws like the Corporations Act 2001 provide a solid foundation for financial reporting and corporate governance practices, fostering investor confidence.

Strategic Location and Gateway to Asia

- Triple-A Credit Rating: Australia is one of only 11 countries with a triple-A credit rating, signifying its strong financial standing.

- Proximity to Growth Markets: Australia’s location offers easy access to high-growth markets like China and Southeast Asia, making it a gateway for companies seeking to tap into these regions.

- Favourable Trade & Investment: Australia’s geographic advantage facilitates trade and investment, positioning Australian-based firms competitively within regional supply chains.

Multicultural Workforce and Cultural Competency

- Adaptable and Innovative Workforce: Australia’s multicultural workforce is known for its adaptability and innovation, offering proficiency in both Western and Asian business cultures.

- Collaboration and Efficiency: This cultural competency fosters collaboration and operational efficiency, particularly advantageous for multinational corporations seeking to establish regional headquarters or expand into diverse Asian markets.

High Quality of Life

- Liveability, Healthcare, and Education: Australia offers a high quality of life with a strong healthcare system and excellent educational institutions, making it an attractive destination for talent and business leaders seeking a work-life balance.

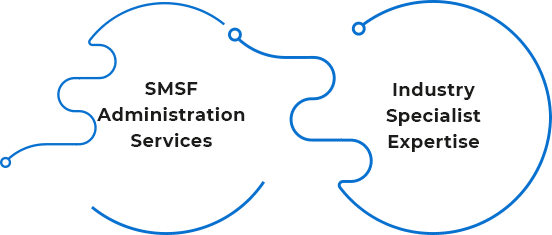

Personal

Personal  SMSF

SMSF