Why Consider CFO Services?

Running a business requires strong financial leadership, but employing a full-time CFO might not be feasible for every company. Our CFO services Australia provide a cost-effective solution by offering access to a qualified and experienced professional on a part-time or project basis.

Benefits of CFO Services:

- Financial Expertise: Our CFOs can handle a broad range of tasks, including financial management, accounting, and reporting. This frees you to focus on core business activities.

- Reduced Costs: You won’t incur the full salary and benefits associated with a full-time CFO.

- Strategic Guidance: Our CFOs offer not just accounting tasks, but also strategic financial advice to help your business grow.

There are a broad range of functions that can be provided by our CFO services, they may include:

Financial Management Accounting

- Annual Statutory financial accounts and reporting.

- Monthly and periodic general accounting, including bank, general ledger, payables, receivables, payroll and fixed assets reconciliations, etc.

- Financial statements preparation in accordance with your requirements (IFRS or GAAP) on a monthly, quarterly, or yearly, basis.

- Treasury functions and management.

- Preparation of Board Meeting reporting packs and minutes.

Payroll Services – Fully Integrated

- We use ATO-approved “One Touch” cloud payroll systems for calculations and payments to employees in accordance with federal and state awards and entitlements (Sick Leave, Annual Leave, Maternity Leave, Part-time and temporary workers, etc.)

- Superannuation Guarantee payments to superannuation funds

Payroll Reports

- Employees entitlements reporting

- Fully compliant leave management with Employee portals, with automated leave application and approval process

- Management of all other payroll issues.

- Integration with timekeeping software such as “Time Minder” and “Deputy” etc

- Annual reconciliation of PAYG Summaries to ATO and State Payroll Tax

Tax Lodgement and Compliance Services

- Business Activity Statement (BAS) preparation and lodgement in accordance with GST (similar to ‘VAT’) statutory requirements.

- Income Activity Statement (IAS) preparation and lodgement.

- Preparation, lodgement and advice related to Company Tax Returns.

International

International

Business

Business

Personal

Personal

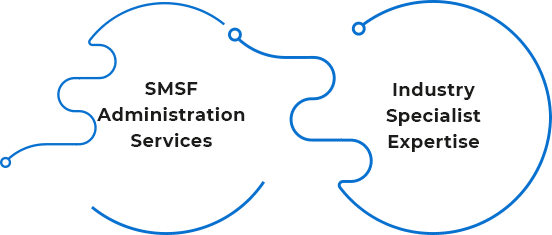

SMSF

SMSF