Types of Company Structures in Australia

- Sole Trader: The most straightforward option, ideal for solopreneurs. You enjoy complete control, keep all profits, but shoulder full responsibility for business debts.

- Partnership: A collaboration between 2-20 individuals who share resources and profits. Partners hold joint and several liability, meaning each partner can be held responsible for the entire debt if necessary.

- Joint Venture: A temporary partnership between two or more parties for a specific project. Each party contributes resources, shares profits and risks as per the pre-defined agreement.

- Trust: A business entity established for the benefit of beneficiaries. A designated trustee manages the business assets as outlined in the trust deed. Trust structures can be complex and require professional guidance.

- Australian Resident Company: A separate legal entity offering limited liability protection for its shareholders and directors. There are two main categories:

- Proprietary Company (Pty Ltd): The most popular choice for small and medium businesses. Pty Ltd companies are unlisted and offer more flexibility in ownership and management compared to public companies.

- Public Company (Ltd): Larger companies listed on the Australian Securities Exchange (ASX). Public companies have stricter regulations regarding ownership structure, reporting requirements, and investor relations.

- Foreign Company: Can operate in Australia through a branch office or a subsidiary company established specifically for Australian operations. Registration with ASIC (Australian Securities and Investments Commission) is mandatory, and additional reporting obligations may apply.

Personal

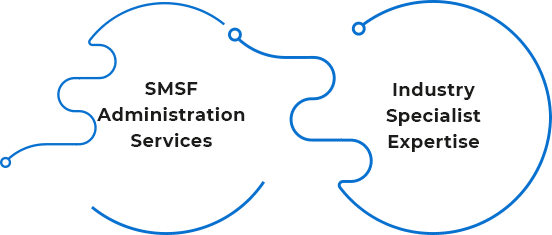

Personal  SMSF

SMSF