Business Tax Australia: Expert Advice for Your Australian Business

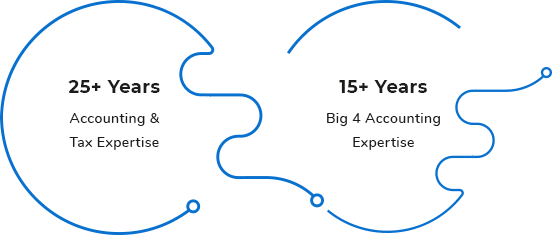

Australian Accountants is your trusted partner for navigating the complex landscape of Australian business tax. With over 20 years of experience, our qualified tax accounting team is dedicated to providing timely, expert advice to help you optimize your business operations and maximize your profits.

Comprehensive Tax Services for Australian Businesses

Whether you’re a small family-owned business or a multinational corporation, our comprehensive range of tax services can help you:

- Tax Compliance: Ensure accurate and timely filing of all federal, state, and local tax returns.

- Tax Planning: Develop strategies to minimize your tax liability and optimize your financial position.

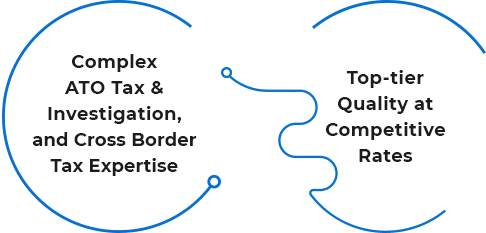

- Tax Audits: Represent your business in tax audits and negotiations with tax authorities.

- Tax Advice: Receive expert guidance on a wide range of tax issues, including deductions, credits, and exemptions.

Payroll Services: Accurate and Efficient Processing

Our efficient payroll services can help you:

- Timely Payments: Ensure employees receive their wages on time, every time.

- Accurate Calculations: Avoid errors in payroll calculations and deductions.

- Compliance: Adhere to all federal, state, and local payroll regulations.

- Employee Satisfaction: Maintain a positive workplace culture by providing accurate and timely payroll information.

Tailored Solutions for Your Business Needs

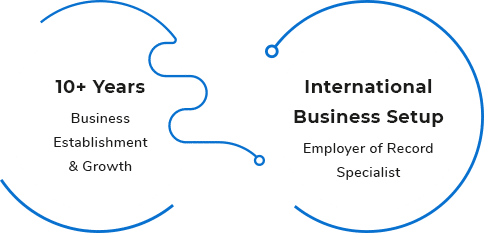

At Australian Accountants, we understand that every business is unique. Our team will work closely with you to develop customized solutions that address your specific tax and financial goals. We offer a wide range of services, including:

- Financial Reporting: Prepare accurate and informative financial statements.

- Business Advisory: Provide strategic guidance on business growth and development.

- Bookkeeping: Maintain accurate and up-to-date financial records.

- Cash Flow Management: Improve your cash flow and optimize your working capital.

Personal

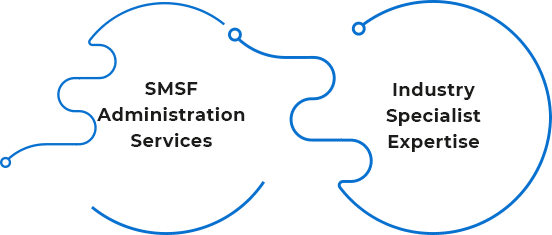

Personal  SMSF

SMSF