What Does Annual Compliance Australia Entail?

Annual compliance Australia involves various tasks and reports submitted to the Australian Taxation Office (ATO) and the Australian Securities and Investments Commission (ASIC). The specific requirements depend on your business structure (sole trader, company, partnership, trust) and activities.

Key Annual Compliance Areas in Australia:

- Business Activity Statements (BAS): BAS reports summarise your business’s activity for a specific period, typically monthly or quarterly. They report on:

- Goods and Services Tax (GST): You report your GST activity via monthly or quarterly statements or by paying regular instalments with an annual report at the year’s end.

- Pay As You Go (PAYG) Withholding Tax: This tax is withheld from employee salaries and reported on your BAS statements.

- Pay As You Go (PAYG) Instalments: Prepayments towards your income tax liability.

- Fringe Benefits Tax (FBT): Certain employee benefits may be subject to FBT, also reported on your BAS statements.

- Wine Equalisation Tax (WET) and Luxury Car Tax (LCT): These are applicable taxes reported on BAS statements for specific industries.

Other Key Annual Compliance Areas in Australia:

- Annual Income Tax Return: Due at the end of the financial year (June 30th), this report details your business’s income and expenses based on your profit and loss statements. The format differs for sole traders, companies, partnerships, and trusts.

- Fringe Benefits Tax (FBT) Return: Due by March 31st, this report details any taxable fringe benefits provided to employees by your company.

- Annual Payment Summary (APS) Reports: Due by August 15th, this report summarises your employee’s PAYG Withholding and Salary and Wages information for the ATO.

- ASIC Annual Company Statement: Due on the anniversary of your company’s formation. This involves paying an annual fee to ASIC and confirming your company’s ability to meet its debts.

Personal

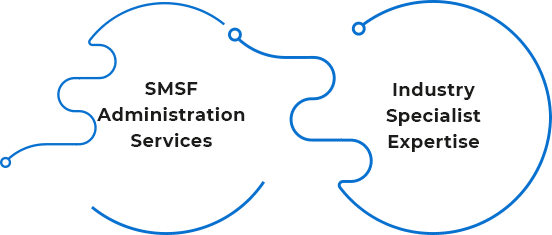

Personal  SMSF

SMSF