Accounting Software Australia: Expert Guidance from Australian Accountants

At Australian Accountants, we understand that every business operates differently, and as such, they require accounting software tailored to their unique needs. With so many options available, it can be challenging to choose the right solution. To assist you in making an informed decision, our team of expert MYOB, QuickBooks, and Xero partners offers comprehensive training and support, ensuring that your accounting software Australia works perfectly for your business.

Here’s a breakdown of the most popular accounting software options for businesses in Australia:

MYOB – The Australian Standard for Accounting Software

For many businesses across Australia, MYOB (Mind Your Own Business) has become the go-to solution. Trusted by thousands of small to medium-sized businesses, MYOB provides comprehensive functionality and flexibility. Whether you need assistance with inventory management or payroll processing, MYOB’s user-friendly interface simplifies complex financial tasks, making it easier to manage day-to-day operations.

Key Features of MYOB:

- Inventory Control: Reliable and accurate, MYOB’s inventory system helps small to medium-sized businesses keep track of stock, ensuring you never over-order or run out of critical supplies.

- Payroll Systems: MYOB’s payroll functionality is robust, supporting a wide range of employment scenarios. From superannuation to taxation, it provides the reporting and compliance features required for businesses operating under Australian tax laws.

- Local Compliance: MYOB ensures that your business stays compliant with Australian Tax Office (ATO) requirements, offering tools that streamline BAS lodgement, payroll tax, and other regulatory needs.

Ideal for businesses looking for local support and a proven track record in Australia, MYOB remains one of the top accounting software solutions in the country.

QuickBooks – In-Depth Reporting for Australian Businesses

QuickBooks is perfect for businesses that require more advanced reporting and detailed financial insights. Many Australian accountants and business owners choose QuickBooks for its versatility in extracting detailed reports and managing finances with ease.

Why Choose QuickBooks?

- Advanced Reporting: QuickBooks allows users to generate custom reports, offering detailed insights into cash flow, profit and loss, and business performance. This level of reporting is ideal for Australian businesses that need comprehensive financial analysis to make informed decisions.

- User-Friendly: Despite its powerful features, QuickBooks remains user-friendly and accessible for business owners with varying levels of accounting experience.

- Multi-Device Access: Whether you’re in the office or on the go, QuickBooks offers seamless integration across desktop and mobile devices, making it easier to manage your business finances from anywhere in Australia.

With QuickBooks, you’ll have the tools necessary to streamline your financial processes, reduce errors, and gain deep insights into your business performance.

Xero – The Cloud-Based Solution for Tech-Savvy Start-Ups

If you’re a start-up or tech-savvy business looking for a fully cloud-based accounting solution, Xero may be the perfect fit. Known for its intuitive interface and paperless functionality, Xero has become a favourite among Australian businesses that prioritize flexibility and innovation.

Xero’s Advantages:

- Cloud-Based and Paperless: Xero is designed with modern businesses in mind, allowing for easy access and real-time collaboration between business owners and accountants, no matter where they are located in Australia.

- Automation: Xero’s innovative features include automatic bank feeds, reconciliation, and invoicing, saving you valuable time.

- Add-Ons and Integrations: While Xero’s inventory system may not be as advanced as MYOB or QuickBooks, it offers a wide range of integrations with third-party apps. This flexibility allows businesses to customize their Xero experience to suit their unique requirements.

- Compliance with Australian Regulations: Xero ensures that your business complies with ATO regulations, offering seamless BAS lodgement and STP (Single Touch Payroll) reporting.

Xero is an ideal choice for businesses looking to embrace cloud technology, offering a paperless, flexible solution that grows with your business.

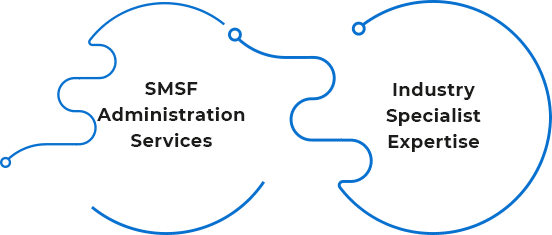

Personal

Personal  SMSF

SMSF