Payroll Services Australia: Your Trusted Partner for Hassle-Free Payroll Management

Are you overwhelmed by the complexities of payroll administration in Australia? Look no further. Our comprehensive payroll services Australia are designed to alleviate your burdens and ensure compliance with the ever-changing Australian tax laws.

Key Features of Our Payroll Services:

- Accurate Payroll Calculations: We handle all payroll calculations, including PAYG, Superannuation, statutory sick pay, maternity pay, and student loan deductions, ensuring timely and correct payments.

- Timely and Compliant Processing: Our experienced team ensures your payroll is processed efficiently and in accordance with Australian tax regulations, minimizing the risk of penalties and fines.

- Employee Self-Service Portal: Empower your employees with a secure online portal to view pay stubs, update personal information, and request leave, streamlining the HR process.

- Superannuation Contributions: We manage your superannuation contributions, ensuring compliance with the Superannuation Guarantee Levy (SGL) and timely payments to your employees’ superannuation funds.

- Payroll Tax Compliance: Our experts keep track of payroll tax rates and ensure your business meets all payroll tax obligations, including lodgement deadlines.

- Leave Management: We assist in managing employee leave entitlements, including annual leave, sick leave, and long service leave, ensuring accurate calculations and compliance with Fair Work laws.

- Reporting and Analytics: Generate comprehensive payroll reports to track employee costs, analyze labor trends, and make informed business decisions.

- Payroll Outsourcing: Completely outsource your payroll function to our team, allowing you to focus on core business activities.

Personal

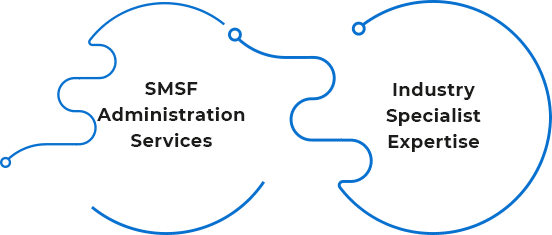

Personal  SMSF

SMSF