Understanding the Australian Taxation Office (ATO)

The Australian Taxation Office manages Australia’s tax and superannuation systems, and its role is essential to the country’s financial infrastructure. However, engaging with the ATO can be complex and challenging for many individuals and businesses. From unclear notices to unexpected audit requests, any communication from the ATO may raise questions or concerns. Australian Accountants is here to simplify this process for you. We represent your best interests, making sure your tax matters are handled efficiently and professionally.

Comprehensive Services for ATO Representation

At Australian Accountants, we offer a broad range of services to support you in all areas of Australian Taxation Office interaction. Our team is equipped to handle the following:

- ATO Correspondence Management

We will assess and respond to any letters, notices, or documents you receive from the ATO, explaining their significance and advising you on any necessary actions. Our team will manage the process from start to finish, ensuring your responses are timely, accurate, and in compliance with Australian tax laws. - Tax Audit Support and Preparation

If you are selected for an ATO audit, Australian Accountants can guide you through the process. We assist in gathering documentation, preparing responses, and addressing audit requirements. Our goal is to present your case transparently and thoroughly, reducing the stress associated with audits. - Error Detection and Rectification

Occasionally, the ATO may make errors in its assessment of your tax affairs. If we identify any inaccuracies, we will work with the ATO to correct these issues. Our team ensures that you only pay the correct tax amount and receive any refunds you’re entitled to. - Special Circumstances Representation

In cases where unique or challenging situations arise, such as financial hardship or extenuating personal circumstances, we can work with the ATO to apply for special consideration. This service is especially beneficial if you require extensions, payment plans, or other accommodations. - Tax Dispute Resolution

Should you disagree with an ATO assessment, Australian Accountants will guide you through the appeals process, ensuring your case is represented clearly and fairly. We handle dispute resolution with professionalism and persistence, aiming to achieve the best possible outcome for you.

What to Expect When Working with Australian Accountants

Our Australian Taxation Office representation service begins with a consultation to understand your current situation, review relevant documents, and clarify your concerns. We then outline a plan of action and take the necessary steps to engage with the ATO on your behalf. Whether the matter is resolved within hours or requires a more extended process, we keep you informed every step of the way.

- Initial Consultation

During our first meeting, we’ll review your concerns, identify any potential issues, and gather all necessary documentation. - Analysis and Strategy Development

Our team will assess your case, determine the best approach, and develop a strategy to address your ATO concerns. - ATO Communication

Australian Accountants will handle all correspondence and communication with the ATO on your behalf, ensuring clear, accurate, and timely responses. - Resolution and Follow-Up

Once a resolution is achieved, we’ll provide a detailed summary and ensure you understand any follow-up steps, whether they involve document retention, tax adjustments, or other actions.

Common ATO Issues We Handle

Australian Accountants has extensive experience in addressing a wide range of ATO-related issues, including:

- Unanticipated tax debts or penalties

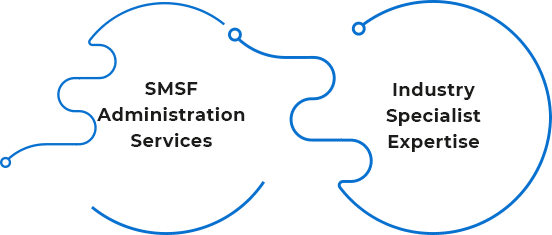

- Queries regarding self-managed superannuation funds (SMSFs)

- Notices for omitted or inaccurate tax returns

- Business and individual tax audits

- Late lodgement and penalty negotiations

- Support for individuals with extenuating circumstances, such as medical issues or financial hardship

Personal

Personal  SMSF

SMSF