Tailored Tax Planning Strategies for Australian Businesses and Individuals

At Australian Accountants, we offer a comprehensive range of tax planning services, specifically tailored to suit the unique needs of Australian businesses and individuals. After an in-depth consultation with one of our tax advisers, you’ll gain clarity on the tax implications of different investment strategies, asset management approaches, and business decisions. Our aim is to help you minimise exposure to taxes such as:

- Income Tax

- Capital Gains Tax (CGT)

- Goods and Services Tax (GST)

By partnering with us, you’ll receive expert advice on how to structure your finances and investments for optimal tax efficiency.

Why is Tax Planning Important?

Tax planning in Australia is more than just compliance; it’s about making smart decisions to minimise tax exposure and maximise financial outcomes. Whether you’re a business owner, investor, or high-income earner, proactive tax planning can help you manage risks, boost after-tax income, and achieve long-term financial goals.

Our Tax Planning Services

At Australian Accountants, we provide clear and actionable tax advice in the following areas:

1. Salary Packaging

Salary packaging (or salary sacrifice) is a tax-effective way to maximise your take-home pay. Our tax experts will help you structure your salary package to include benefits such as vehicles, superannuation, or electronic devices, ensuring you reduce your taxable income in line with Australian tax laws. By optimising your salary package, you can enjoy immediate tax savings while enhancing your overall compensation.

2. Investment Gearing

Leveraging your investments with effective gearing strategies can help you build wealth while minimising tax liabilities. Whether it’s negative gearing for property investments or gearing into shares and managed funds, we’ll advise you on the best options to maximise tax deductions and achieve long-term financial success. Gearing your investments smartly can turn your tax obligations into growth opportunities.

3. Maximising Tax Credits

As part of your investment portfolio, you may be eligible to receive various tax credits, such as franking credits from Australian shares. We’ll guide you on how to structure your portfolio to maximise your tax credits and potentially reduce your overall tax burden. This can be particularly beneficial for investors looking to optimise returns in a tax-efficient manner.

4. After-Tax Income Maximisation

We focus on strategies that help you retain more of your hard-earned money. From personal tax deductions and income splitting to restructuring your finances for better tax outcomes, our team is committed to helping you achieve the highest possible after-tax income. Our tailored tax planning solutions are designed to work seamlessly with your financial goals, ensuring that you keep more of your wealth.

Personal

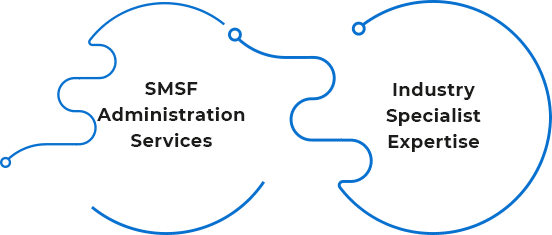

Personal  SMSF

SMSF